Multi-Jurisdiction Company Set-Up and Compliance – BGCORP Solutions

Expanding your business across multiple jurisdictions is a strategic move that can unlock new markets, drive growth, and diversify operations. However, navigating the complex legal, financial, and regulatory frameworks in different countries can be challenging. At BGCORP Solutions, we specialize in Multi-Jurisdiction Company Set-Up and Compliance, offering a seamless, comprehensive service to help businesses establish a global presence while maintaining compliance with local and international regulations.

Our Multi-Jurisdiction Set-Up and Compliance Services

1. Business Entity Formation

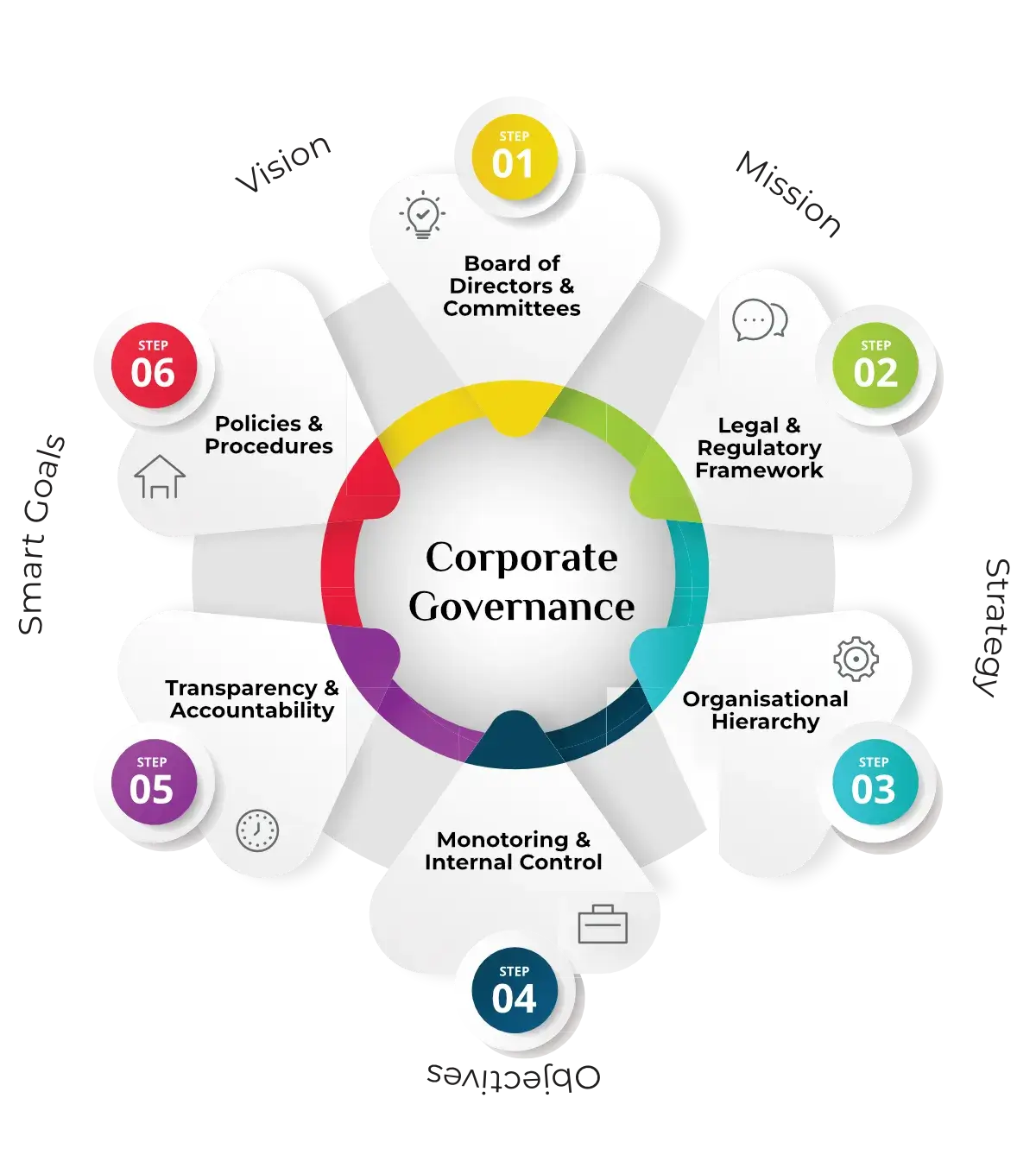

2. Corporate Governance & Compliance

3. Tax Planning and Compliance

4. Employment Law and HR Compliance

5. Banking and Financial Compliance

6. Mergers, Acquisitions, and Cross-Border Transactions

Why Choose BGCORP for Multi-Jurisdiction Set-Up and Compliance?

Our Presence

With a strong international presence, BGCorp Solutions operates in multiple regions to cater to a global clientele. Our offices are strategically located in:

India

UAE

UK

Mauritius

Switzerland

USA

This global reach allows us to deliver localized solutions, ensuring compliance and business strategies that align with the unique regulatory and market landscapes of each country.